Students Stress as College Costs Loom

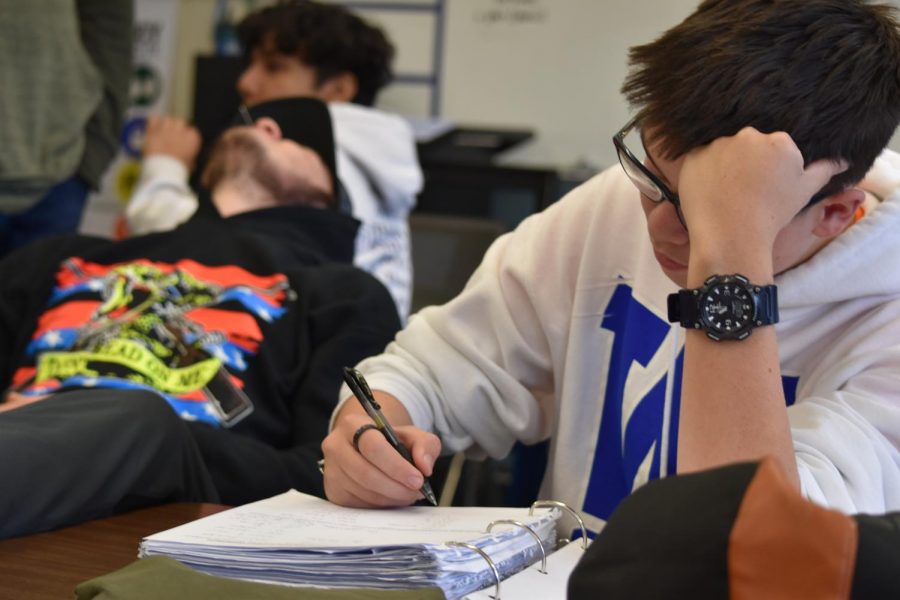

Senior Elijah Price has spent his high school career grade-focused and is now taking the steps needed to apply for college. The rising cost is in the back of his mind, though. Photo by Madisun Tobisch.

December 13, 2019

“Small town, big dreams,” reads the poster in the hallway at Sedro-Woolley High School, but as many students are learning, these dreams can come with a price — one that is out of budget for many.

Over the past decade, a spike in national debt and a decrease in statewide funding of both public and higher education have seen college tuition prices rise. The amount of student- held debt drastically increased as well, forcing many students to reconsider their options in regards to the pursuit of higher education, according to CNBC.

According to a recent statistic from Forbes, college tuition prices are increasing eight times faster than wages, and this statistic excludes other costs such as housing and supplies. Due to this, Forbes explains, student debt makes up the largest part of the non-housing debt in the U.S.

These financial difficulties are posing a challenge for many students, including Sedro-Woolley High School senior Bella Boggs.

“I come from a very low-income based family,” said Boggs. “Even though I’ll get a good amount from FAFSA, my choices are pretty limited to just colleges in-state, because realistically, there’s no way I’ll be able to pay for out of state.”

FAFSA, which stands for the Free Application for Federal Student Aid, is a program designed to help families with yearly incomes under a certain price point. This program helps cover educational expenses like tuition, room and board, and other non-negotiable college expenses. But there is a catch.

“I’m thankful that I’m at a certain amount of income that I’m getting money from FAFSA, but there are kids that struggle just as much as I do. Their parents stress just as much as my mom does to get food on the table, but they don’t get any money because their parents make just above the minimum,” said Boggs.

“I don’t want to put too much cost on my mom,” said Boggs.“I don’t want to have to depend on her in college.”

FAFSA also only covers specific fields of study, which means that many students can still feel the pressure of tuition even with financial assistance available. For many, this has shown to be a key deciding factor where they plan to attend college, if they decide to attend at all.

“Tuition, specifically out of state tuition, is the main deciding factor for what school I’m going to go to,” said senior Isaiah Guerro.

“I loved George Fox University, which is a private christian school down in Newport Oregon but their tuition alone is like over 40,000 dollars plus room and board is over 60,000 a year,” said Guerro.“I’d love to go there, they have a really good team and really good academics programs, but it would be a better bet for me to go somewhere cheaper”

Another senior, Asia McDermott, also voices concern about student debt,-more specifically about how debt can impact not only the person directly affected, but also the people around them.

“It’s frustrating how we can take advantage of so many kids,” said McDermott. “Then you’re in debt because they are telling you to get loans and then your loans cause your downfall. And then if you get married, your partner has to share your loans with them.”

College and Career counselor at SWHS, Jen Daley, believes that those motivated enough will find a way to make ends meet. “If tuition does increase, student expectations of what they need to pay will just increase as well. If students want to pursue higher education they will pay for it one way or another,” said Daley.

Evidently, they are, but in order to be able to do this many students are resorting to working while in school in order to cover the cost of tuition, though this proves to be a struggle for many.

“My advice would be to not work full time (if you can). Focus your time on learning because the time will go by so fast,” said former graduate of Western Washington University and teacher at Big Lake Elementary School, Tana Huchel.

“College is so time consuming as it is; being able to keep up with grades as well as being able to make the money to keep going to college,” said Boggs. She also recognizes how other members of her family have struggled to work and pay off debt.

“My sister went to UW and she worked at one of the best dentist’s offices in Washington state, and she made a very good amount of money, and walking out of college, she’s still like 30,000 dollars in debt,” said Boggs. “That’s a lot of stress on me. Like for me to think that she’s making as much money as she possibly can and still is so much in debt.”

Huchel adds that “college tuition prices have almost doubled since I graduated with my bachelor’s in 2014. I pay double for my master’s program tuition with less financial aid and support.”

According to the New York Times, A recent bill projected to be signed by Washington State Governor Jay Inslee in early 2020 promises to make college tuition for students in Washington state more affordable,- eliminating wait lists for financial aid and providing extra aid to families of four earning $50,000 a year or less. Though this bill does not apply to every student, many students believe that this step towards affordable college tuition could provide them extended opportunities, ”It would open up the door to so many different opportunities than what most kids have,” said Senior Mitchell Wolkenhauer. “Like if you don’t have the time, if you are working while you are applying for college, its really difficult to get all the scholarships and all the different opportunities that you could take.”

A recent poll taken of a sample group of Sedro-Woolley High School students shows that 66.7% of students are still planning on attending college, despite rising prices. Of these 132 students polled, 22.7% of students are still unsure about their decision to attend college, and only 10.6% of the students polled are not planning on attending.

For this 10.6% percent, many students have voiced concerns about having extended college prep classes, and offering opportunities for students to be taught other alternatives to college.

“There’s no way any of us are going to have it one hundred percent figured out,” says Wolkenhauer.

“There need to be more college-help classes and encouragement. Not encouragement to know what you are going to do, but to find what you are going to do,”he says. “it’s so frowned upon to not go to college in today’s society”.

As far as other options besides college, Jen Daley explains that are opportunities for students who want to succeed after high school without attending college.

“The cost of attending vocational school is significantly lower and many of the programs are shorter,” said Daley. “Apprenticeship programs, in particular, have an amazingly quick return on a student’s investment of time and money, with high paying jobs directly after graduation.”

Vocational schooling, one of the options mentioned by Daley, consists of a series of programs based around career-focused education, designed for students looking to go into a specific field of study. They are often referred to as trade schools, and according to an article from the Universal Technical Institute (UTI), many of these schools can be significantly less expensive and more accessible than a standard university education, especially for students planning on going into a very specific field of study.

This is only one of the many options available to students looking to pursue higher education, though each program has its individual setbacks. Universities provide educational opportunities for a wide range of careers, though the prices of their tuition poses many challenges, and even if students work while attending they can still struggle to sustain themselves financially. Scholarships and financial aid can be viable options to cover these costs, though they aren’t always available to all students. Even Trade schools, though less expensive, only cater to a small scope of career paths, and the programs offered are usually shorter and don’t meet the requirements needed to pursue certain jobs. Due to this, choices students make in regards to college can be very difficult and complex, as explained by senior Elijah Price,

“ I think there is way too much pressure put on students by high schools to have it figured out,” says Price, “we’re still kids.”